Moneyview Personal Loan: Money View Personal Loan is available with a fair interest rate and 3 Month to 5 Years period of repayment. Through this app, you can get a loan of 10000 to 1000000 with very little interest.

MoneyView Loan is available with an annual interest rate of 16% to 39% to meet your monetary requirement. You can use this amount to repair the home, domestic expenses, wedding expenses, etc. Money View Personal Loan can be helpful for you due to its low-interest rates and flexible tenure.

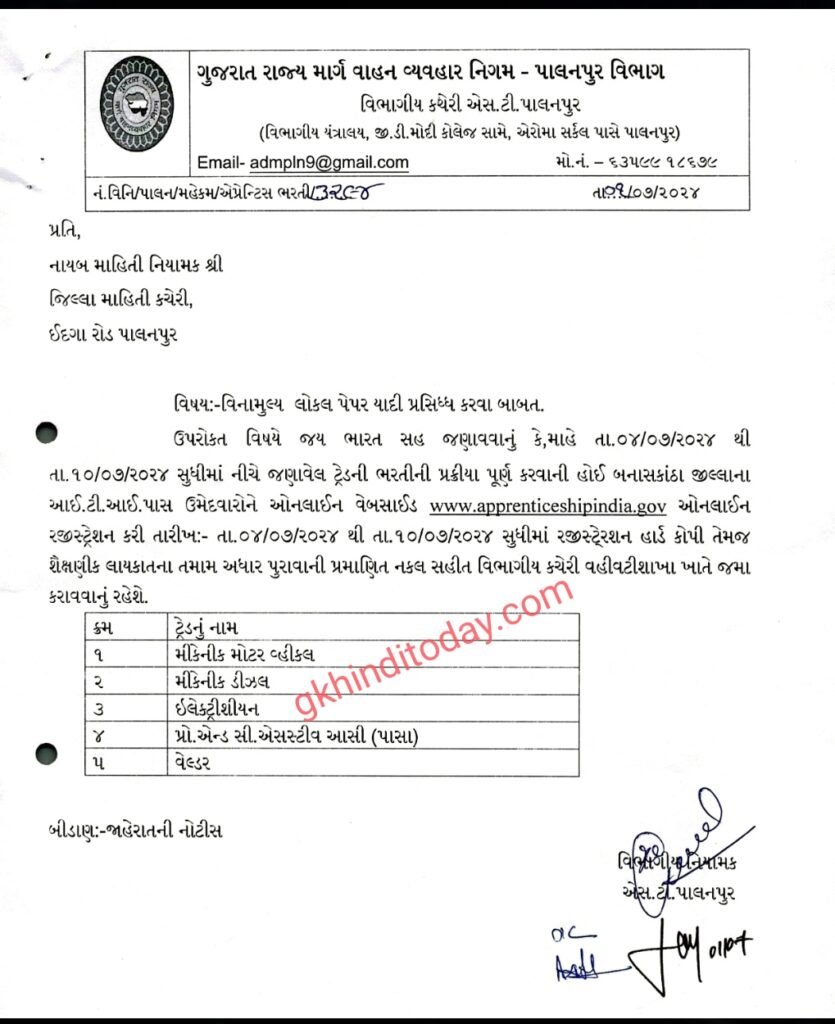

| Gsrtc પાલનપુર 10\12\iti પર ભરતી છેલ્લી તારીખ 10/07/2024 | સંપૂર્ણ માહિતી જાણો |

Moneyview Personal Loan

| Loan App Name | Moneyview |

| Interest Rate | 16℅ To 39℅ Per Annum |

| Processing Fees | Processing Fees of 2% to 8% will be deducted from the loan amount + GST |

| Loan Tenure | 3 Months tony Years |

| Amount of Money | Up to 8 lakhs |

| Official Website | moneyview.in |

Money View Personal Loan Feature

there are many advantages to taking Instant Personal loans in Money View Loan App. After knowing about it, you would also like to take instant loans through this app. This app can help meet your monetary requirements.

Instant Loan Approval: MoneyView loan app uses advanced technology to provide instant loan approval to eligible applicants.

Competitive Interest Rates: The app offers attractive rates of interest that are competitive with other personal loan providers. With MoneyView, interest is only applied to the amount as much as you have used, not to the total amount of money approved for you.

Flexible Loan Tenure: Users can choose a loan tenure that best suits their repayment capabilities. Borrowers are given a time of 3 to 60 months to pay the loan. Loan EMI will depend on the loan period you choose.

Customizable Loan Amount: Users can select the loan amount per their requirement up to a specific limit.

Easy Loan Tracking: Users can track the status of their loan application and disbursement through the app.

Multiple loan options: Money View offers numerous loan options like personal loans, business loans, and home loans

Online Repayment: Users can pay the loan through the app using various modes like online banking and credit/debit cards.

EMI Calculator: Users can use the in-built EMI calculator to know the EMI to be paid before availing of the loan

It is important to note that the features and terms of service provided by the app may vary depending on the type of loan, so it is always important to check the terms and conditions of the app before applying for a loan.

Moneyview Personal Loan Interest Rate

However, Moneyview Loan is a fintech company that provides personal loans to individuals. The interest rate on a personal loan through Money View Loan App would depend on various factors such as creditworthiness, income, and loan amount. In general, Money View personal loan interest rates can range from around 16% to 39% per annum.

Money View Personal Loan Eligibility Criteria

- Only Indian citizens can apply for personal loans.

- The person should not be less than 21 years.

- Should have a monthly source of income.

- You must have a monthly Salary income of Rs 13,500 and a Self-employed Person income of 25,000.

Money View Customer Care Number

By Phone: You can call on the company’s customer care number 080-4569-2002

Email: You can also contact customer care via email. The email address for specific queries is below:

- Loan Payment Queries: payments@moneyview.in

- Loan queries: loans@moneyview.in

- General queries: feedback@moneyview.in

Important link

| Money View Personal Loan | Click Here |

| Homepage | Click Here |

Read more :

IDBI Bank offers personal loans

HDFC Credit Card Loan: How to take loan from HDFC credit card?