Post Office 399 Insurance Scheme: Life is full of uncertainties and accidents can happen at any time. While accidents are not planned for, one can certainly plan for contingency expenses. Now, IPPB’s Group Personal Accident Insurance provides accident coverage to all its customers. Buying contingency insurance can be the best option to keep unexpected expenses under control. IPPB customers aged 18-65 years can avail these two policies for one year by paying the required premium.

Important update

| Gujarat forest guard result | Check cut off merit list |

| GSSSb Final Answer Key | Click here |

Post Office 399 Insurance Scheme

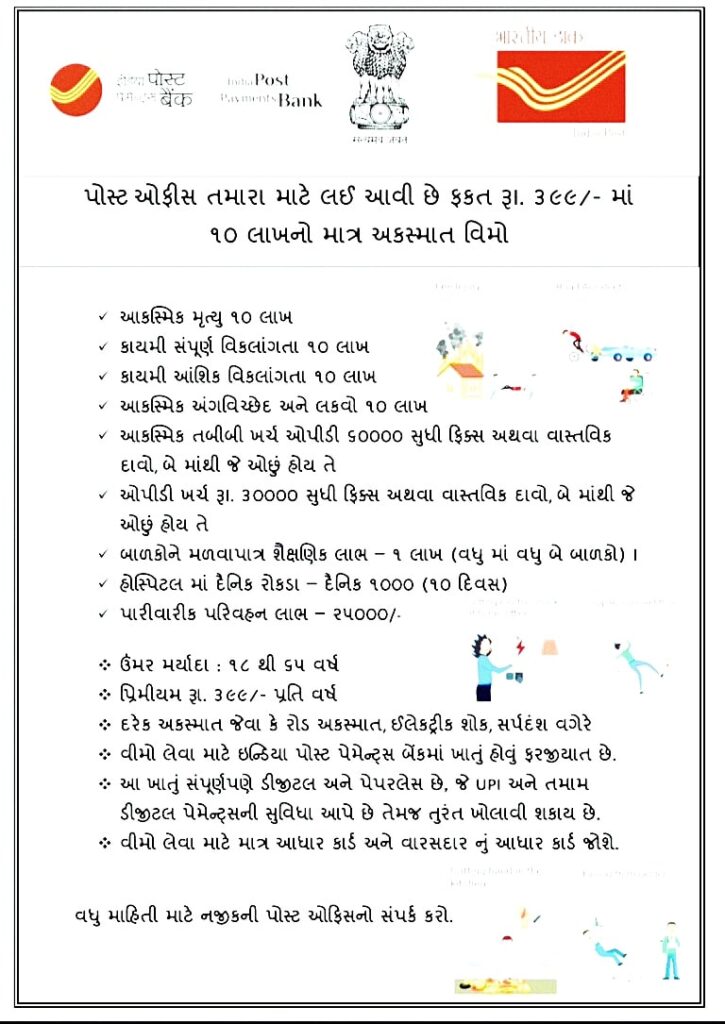

Post Office 399 Insurance Scheme: With this post office insurance you will get Rs.10 lakh insurance at a premium of just Rs.399: India Post not only provides postal services but when it comes to banking services, it is a medium for many people especially in rural areas. Today India Post has a vast network across the country. Now, in order to protect its customers from accidental death or disability, India Post Payments Bank offers only Rs. 399 and Rs. 299 has issued a contingency insurance policy. While the premium plan for IPPB customers is Rs. 399, the basic plan is priced at Rs. 299 is.

Also read

Atal Pension Scheme 2024 (APY) Objectives, Eligibility

Bike Sahay Yojana 2024 | Rs 45000 subsidy for purchase of motor cycle | Assistance Scheme of Govt

Mahila vrutika yojana : woman fo gujarat will get rs 250 per day , apply now

India Post Rs. 399 Premium Insurance Plan

The Rs 399 premium plan offers you cover for one year. It promises you Rs 10 lakh in case of accidental death or permanent total disability, permanent partial disability and accidental dismemberment and paralysis. Accidental medical expenses can also be claimed in IPD up to Rs 60,000 in case of accidental medical expenses in OPD and Rs 30,000 in IPD.

India Post Rs. 299 basic insurance plan

with its Rs. 299 as part of the basic insurance plan, IPPB in case of accidental death or permanent total disability, permanent partial disability and accidental dismemberment and paralysis of Rs. 10 lakhs coverage is offered. However, this policy premium is Rs. 399 does not offer benefits like education benefit, hospital daily cash, family transport benefits and funeral benefits offered under the scheme. However, Rs. 299 plan, in case of accidental medical expenses in IPD Rs. 60,000 and in case of incidental medical expenses in OPD Rs. 30,000 offers.

India Post Payments Bank (IPPB) has come up with an accident insurance plan that will surely please the customers. Annual for premium version is Rs. 399 for the basic version and Rs. 299, the plan will protect customers in case of accidental death, disability or financial loss. The group accident insurance plan offered by IBPB provides coverage for one year in case of any unforeseen event, with benefits for medical expenses, education and more.

Important link

| Post Payment Bank Official Website | View |

| Home page | Click here |